Chancellor Jeremy Hunt is uncertain if the federal government can afford additional tax cuts – as a Nationwide Insurance coverage (NI) discount comes into pressure at the moment.

The pre-election lower to NI, from 12% to 10%, will influence round 27 million payroll workers throughout the UK.

An individual incomes the UK’s common wage of £35,000 will save £450 a 12 months, or £37.38 a month, on account of this transformation.

Cash newest:

See how a lot your pay will change

Mr Hunt stated the discount, introduced in his Autumn Assertion final 12 months, means “{that a} typical household with two earners might be almost a thousand kilos higher off this 12 months”.

However Labour argued this wasn’t true, saying frozen revenue tax and nationwide insurance coverage thresholds imply that many households have been drawn into greater tax bands.

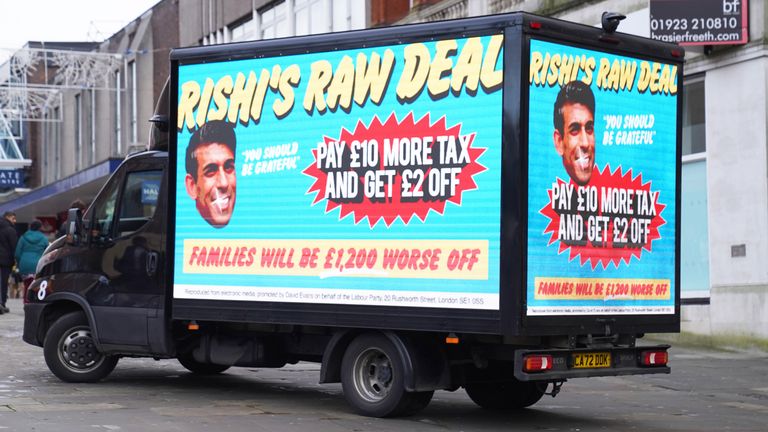

The Opposition’s new assault adverts criticising the coverage even made it onto the Tory-supporting web site Conservative House on Friday.

Shadow chancellor Rachel Reeves stated: “Beneath Rishi Sunak’s uncooked deal, for each further £10 persons are paying in tax they’re solely getting £2 again.”

‘If I can afford to go additional I’ll’

In an announcement on Saturday, Mr Hunt stated he needed to additional ease the tax burden, which is predicted to rise to the best stage for the reason that Second World Conflict earlier than the top of this decade, however he does not but know if he can.

He referred to as the NI discount “the beginning of a course of”, including: “If I can afford to go additional I’ll… I do not but know if I can.

“We need to do that as a result of it helps households, it additionally helps to develop the economic system, and we imagine {that a} flippantly taxed economic system will develop sooner and ultimately that’ll imply more cash for public providers just like the NHS.”

Mr Hunt argued the Conservative authorities “desires to convey down taxes” and recognises that “households are discovering life actually powerful”.

However he defended its earlier measures, saying: “It was proper to help households via COVID and thru the price of dwelling disaster, and sure taxes needed to go up in that interval.”

The federal government says its NI discount is the most important tax lower on report for staff.

The chancellor added: “Even after the impact of the tax rises which have occurred beforehand, which means that a typical household will see their taxes go down subsequent 12 months.”

Will Hunt lower taxes once more earlier than election?

The clock is ticking for Mr Hunt to seek out the fiscal headroom to chop taxes once more.

The spring finances, pencilled in for six March, would be the final likelihood for him to make main tax and spending guarantees earlier than the election, which Mr Sunak has stated will seemingly be within the second half of the 12 months.

Following the Autumn Assertion in November, the federal government has confronted stress from Tory MPs to go additional and lower revenue tax or inheritance tax.

Whereas many campaigners welcomed the Nationwide Insurance coverage modifications, they identified that the tax burden stays at report excessive ranges for Britons – thanks partly to the edge at which individuals begin paying private taxes being frozen, somewhat than rising with inflation.

Mr Sunak launched the present tax freezes when he was chancellor again in 2021 and as prime minister, prolonged the time they’d should be in place, from 2026 to 2028.

This causes a so-called “fiscal drag” as pay goes up however tax thresholds do not, so extra persons are dragged into greater tax brackets.

The Institute for Fiscal Research has stated the Autumn Assertion gave again simply £1 in tax cuts for each £4 of tax rises as a result of threshold freezes since 2021.

Ms Reeves claimed that regardless of the NI lower, the common household was paying £1,200 further tax this 12 months “due to decisions by Rishi Sunak and this Conservative authorities”.

“By no means have folks paid a lot in tax and received so little in return within the type of public providers,” she stated.

Learn extra:

A delay in calling the election is the very last thing Starmer wants

What 2024 might have in retailer for UK politics

Nevertheless, the Labour management has not dedicated to reducing tax or unfreezing the thresholds in the event that they win the election.

Sir Keir Starmer advised Sky Information his precedence is to develop the economic system and he will not make guarantees he cannot maintain – however that he does need to “decrease the burden of working folks”.