Within the first few months of the brand new yr, the Workplace of Personnel Administration is bracing for a surge in federal retirement claims.

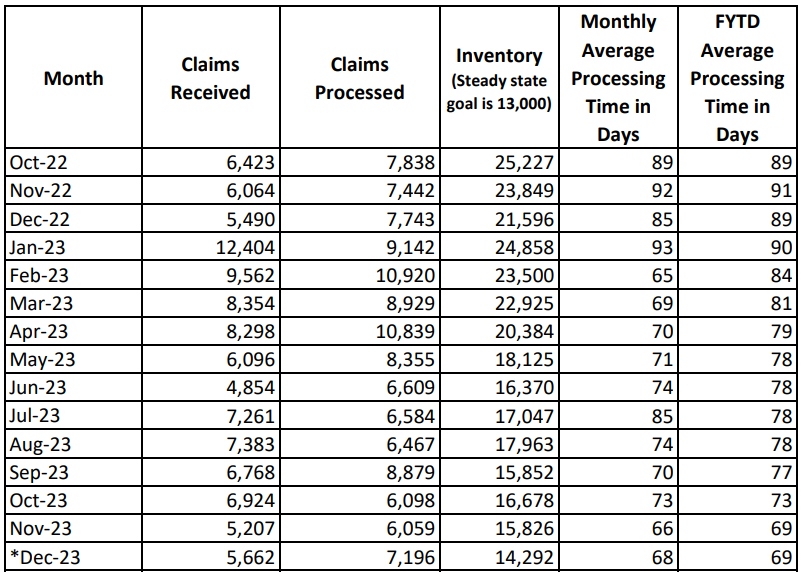

It’s a typical pattern annually for OPM’s retirement providers division. All through 2023, near 89,000 federal workers filed for retirement. About 12,400 of these claims have been processed in January alone, the month with by far the best variety of claims.

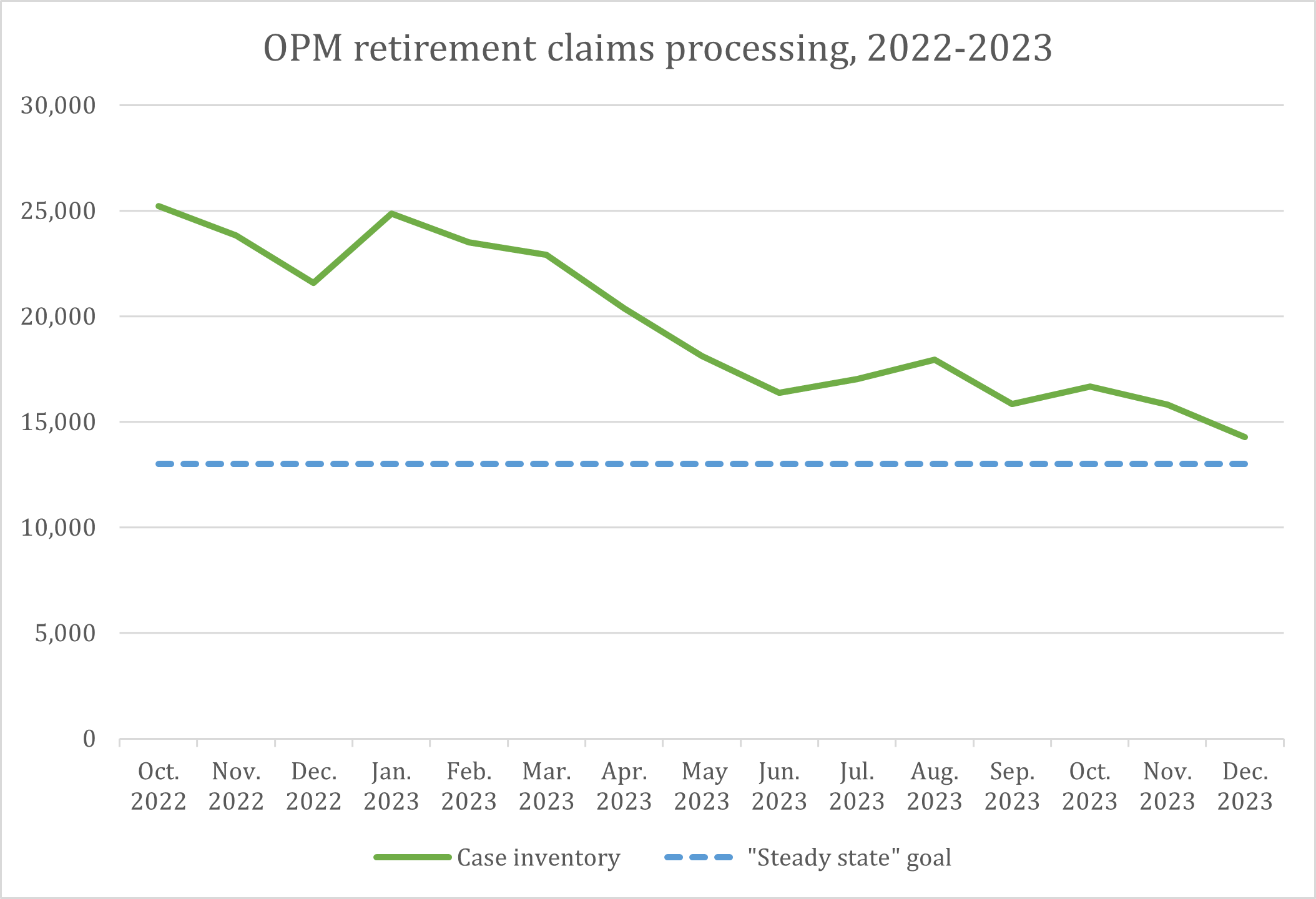

Within the again half of 2023, OPM made important strides in paring down its backlog of unprocessed retirement claims from federal workers.

OPM’s newest retirement report confirmed that there are at the moment 14,292 instances sitting within the stock. It’s the smallest retirement claims backlog since December 2017, when there was a 14,515-case stock.

With a robust end for the yr, the company diminished its case stock total by 34%, a big decline for the reason that roughly 36,000 pending claims that OPM had a few years in the past.

The stock, although, remains to be 1,292 instances above OPM’s “regular state” aim of 13,000, or the variety of instances OPM goals to have in processing at any given time.

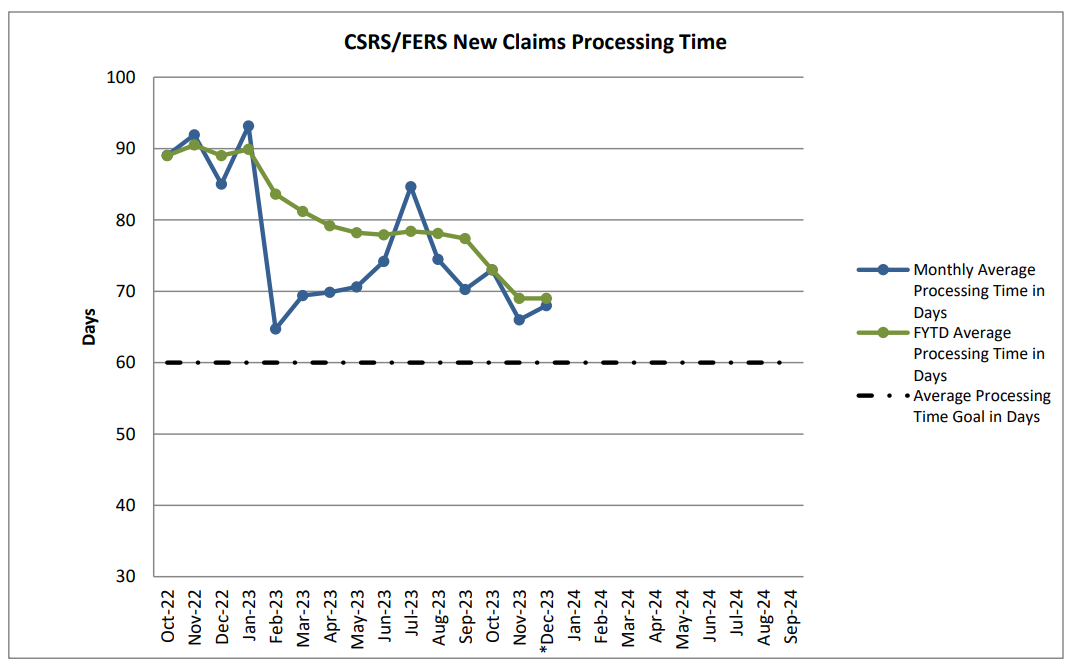

The time it takes OPM to course of instances additionally climbed barely increased in December, reaching 68 days, up two days on common for the reason that 66-day processing time in November.

The quickest month for processing throughout 2023 was February, when OPM was finalizing retirement claims at a mean of a 65-day tempo.

However once more, the processing time remains to be above OPM’s aim of a 60-day common.

The proportion of retirement claims that contained errors additionally trended downward by the tip of 2023.

In December, 14% of retirement purposes had errors, in contrast with 23% in July, in accordance with information from OPM.

A part of the rationale OPM might have been comparatively profitable in processing this yr was as a result of decrease variety of whole feds who retired throughout 2023. The roughly 89,000 feds who retired over the past yr have been considerably fewer than the 103,000 or so who retired throughout 2022.

For the approaching months, OPM Deputy Director Rob Shriver mentioned the company is already making ready for the annual time frame when retirement claims usually ramp up.

“We’ve made actually good progress on retirement, however we’re not the place we have to be,” Shriver mentioned in an interview with Federal Information Community. “And we’re about to step into our surge interval for the yr. We’ll have our work reduce out for us.”

On high of the anticipated surge, ongoing appropriations debates and the potential of a authorities shutdown additionally threaten the power of retirement providers to maintain up the tempo. OPM’s retirement providers employees proceed to work throughout a shutdown, however can’t course of a retirement software with out first receiving the finished software from a retiring worker’s company. Within the case of a shutdown, processing might be delayed when payroll workers at a feds’ using company are furloughed, OPM has mentioned.

And regardless of latest enhancements within the total processing numbers, particular person instances of main delays present the difficulties many federal retirees nonetheless face. On common, instances that took greater than 60 days for OPM to finish had a processing time of 128 days.

However in some instances, the wait instances might be for much longer.

One federal retiree, in an e-mail to Federal Information Community, mentioned he has nonetheless not acquired an annuity cost, greater than two years after he first filed his retirement software with OPM.

In an extended collection of errors together with his software, the retiree mentioned he was first directed to submit his software to the incorrect facility — after which given the incorrect sort of retirement type to undergo OPM. He mentioned the prolonged and paper-based course of in addition to restricted info on the standing of his software have contributed to the continued points.

“I’m nonetheless ready for my first annuity cost for over two years since my federal retirement date with no different substantial revenue,” the retiree, a former Division of Veterans Affairs worker, mentioned in an e-mail. “A easy measure, resembling standardized labeling of the appliance’s standing would permit these purposes to be prioritized, processed faster and separate from the majority of recent purposes additionally being acquired.”

Modernization plans lie forward

OPM has large challenges forward in retirement providers, involving a steadiness of each managing the present system, whereas concurrently planning out a years-long IT modernization venture.

“That’s a giant enterprise,” Shriver mentioned. “I feel there have been efforts prior to now to do it as one large modernization — that hasn’t been as profitable. So we’re simply chipping away, taking a modular method.”

Thus far, OPM has taken a number of steps towards modernizing the method, resembling piloting a web-based retirement software with the aim of ultimately stepping away from the at the moment paper-based system.

“We’re evaluating for attainable continuation and growth,” Shriver mentioned.

Moreover, throughout 2023, OPM rolled out a chatbot pilot, starting on a smaller scale with a comparatively restricted scope of questions the digital software may reply from retiring feds.

“We have now plans to extend the variety of points that folks can get served on by way of the chatbot, in order that they don’t need to name the decision heart as a lot,” Shriver mentioned.

However on the similar time that OPM is engaged on modernization, there are the extra instant wants of at the moment retiring feds.

“We have now those who have to be served, they usually have to be served shortly and successfully,” Shriver mentioned.

To attempt to deal with a few of the extra widespread points, OPM revealed a retirement fast information throughout 2023, and created a number of video tutorials aiming to assist feds higher perceive the steps of the method, and what usually causes delays.

The retirement fast information goals to assist feds get a clearer image and timeline of the method to assist ease their transition to retirement. OPM mentioned it hopes to proactively reply a few of the extra widespread questions on federal retirement, most notably, “what’s the standing of my retirement software?”

The information additionally goals to elucidate widespread errors in retirement purposes to attempt to proactively catch points earlier than they trigger delays. A number of the most typical causes for a delay are lacking signatures or lacking kinds, particularly if a retirement applicant labored at a number of completely different companies throughout their profession.

For the following few months, Shriver mentioned OPM is bringing in employees from different companies to help through the surge interval of retirement purposes.

“We expect it’s a terrific trade to have people who find themselves doing the work on the company aspect, see the way in which that it occurs at OPM, in order that they not solely assist us through the surge interval, however then take that data again to their companies,” Shriver mentioned. “We additionally be taught from the companies, after we’re working aspect by aspect with them, what their ache factors are. We’ve continued to work with companies on enhancing the accuracy of the purposes that come to us, in order that there aren’t as many bumps within the highway with the processing.”

Copyright

© 2024 Federal Information Community. All rights reserved. This web site shouldn’t be supposed for customers situated inside the European Financial Space.