RBI, he mentioned, will not be towards any fintech however its prime goal is to guard the curiosity of consumers and depositors.

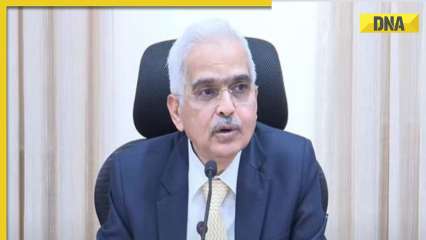

Reserve Financial institution of India Governor Shaktikanta Das on Monday dominated out any assessment of the central financial institution’s motion towards Paytm Funds Financial institution Ltd (PPBL), saying that its choices are nicely thought out. RBI, he mentioned, will not be towards any fintech however its prime goal is to guard the curiosity of consumers and depositors.

Observing that RBI is all the time supportive of the fintech sector, Das mentioned it’s the endeavour of the central financial institution to make sure speedy development of the sector.

With regard to motion taken towards PPBL, he mentioned directives towards any regulated entities are taken each time it finds that they do not take any motion even after they’re advised to adjust to the laws.

“We’ve taken motion towards PPBL after due consideration and shortly FAQs (Continuously Requested Questions) can be issued for the advantage of its prospects,” Das mentioned after the 606th assembly of the Central Board of Administrators of RBI.

The assembly was addressed by Finance Minister Nirmala Sitharaman.

In a serious motion towards PPBL, the central financial institution, on January 31, directed it to cease accepting deposits or top-ups in any buyer accounts, wallets, FASTTags and different devices after February 29.

Ruling out any relaxations, Das on Monday mentioned, “in the mean time, let me say very clearly, there is no such thing as a assessment of this (PPBL) choice. In case your predict a assessment of the choice, let me very clearly say there may be (going to be) no assessment of the choice”.

“FAQs which we’re proposing to situation is concentrating on the inconvenience or points confronted by the depositors and prospects pockets customers, FASTag holders. No matter is within the prospects’ curiosity that we’re dealing in FAQs. Relating to assessment of choice, there may be nothing on the desk,” he mentioned.

Whereas asserting the motion towards PPBL, RBI had mentioned the path follows persistent non-compliances and continued materials supervisory issues.

On March 11, 2022, RBI had barred PPBL from onboarding new prospects with quick impact.

In its newest motion, RBI has requested the PPBL to not take deposits/ credit score transactions/top-ups in any buyer accounts, pay as you go devices, wallets, FASTags, and NCMC playing cards, amongst others, after February 29.

Nonetheless, the central financial institution has allowed credit score of curiosity, cashbacks, or refunds even past February 29.

Additional, withdrawal or utilisation of balances by PPBL prospects from their accounts, together with financial savings financial institution accounts, present accounts, pay as you go devices, FASTags, and Nationwide Widespread Mobility Playing cards, are permitted with none restrictions, as much as their obtainable steadiness.

RBI has additionally directed termination of the ‘nodal accounts’ of One97 Communications Ltd, which owns the Paytm model.

One97 Communications holds a 49 per cent stake in PPBL however classifies it as an affiliate of the corporate and never as a subsidiary.

(Aside from the headline, this story has not been edited by DNA workers and is printed from PTI)